All Categories

Featured

Table of Contents

A taken care of indexed global life insurance policy (FIUL) policy is a life insurance product that provides you the opportunity, when adequately funded, to join the growth of the market or an index without straight spending in the market. At the core, an FIUL is designed to offer security for your enjoyed ones in case you die, but it can likewise give you a large selection of advantages while you're still living.

The key distinctions between an FIUL and a term life insurance policy plan is the adaptability and the advantages beyond the survivor benefit. A term policy is life insurance that guarantees repayment of a mentioned survivor benefit during a specified time period (or term) and a given costs. As soon as that term expires, you have the alternative to either restore it for a brand-new term, end or convert it to a premium coverage.

Be sure to consult your economic professional to see what type of life insurance policy and benefits fit your demands. A benefit that an FIUL uses is tranquility of mind.

You're not subjecting your hard-earned money to an unstable market, producing on your own a tax-deferred property that has built-in protection. Historically, our firm was a term supplier and we're devoted to offering that organization but we've adjusted and re-focused to fit the changing needs of clients and the needs of the industry.

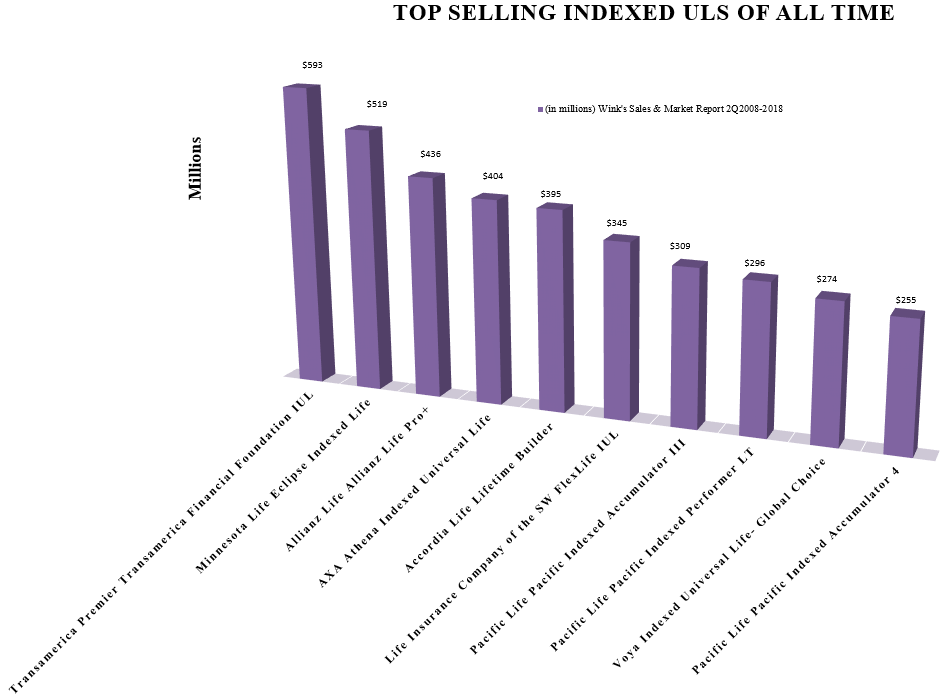

It's a market we have actually been committed to. We have actually devoted sources to developing some of our FIULs, and we have a focused effort on being able to give solid services to consumers. FIULs are the fastest expanding sector of the life insurance policy market. It's a room that's growing, and we're going to maintain at it.

Policy fundings and withdrawals might develop an adverse tax result in the occasion of gap or policy surrender, and will certainly minimize both the abandonment worth and death benefit. Customers must consult their tax expert when taking into consideration taking a policy loan.

Death Benefit Options Universal Life

Minnesota Life Insurance Firm and Securian Life Insurance coverage Business are subsidiaries of Securian Financial Group, Inc.

Term Life Vs Universal

1The policy will plan will certainly end any time the cash surrender value abandonment insufficient to inadequate the monthly deductionsRegular monthly 2Accessing the money value will certainly reduce the readily available money abandonment worth and the fatality advantage.

In 2023, I co-wrote a post on underperformance of indexed global life (IUL) obstructs. One of the prospective chauffeurs of that underperformance was insurance holder actions. Throughout the program of time, actuaries have actually discovered several tough lessons concerning misestimating insurance holder habits and the performance of insurance holders. In this post, I increase on the possible locations of insurance policy holder behavior threat in IUL products and where actuaries ought to pay particular focus to the lessons of the past.

This post delves right into extra actions dangers to be knowledgeable about and hits on the threats talked about in the prior write-up in addition to gives some suggestions on how to check, recognize and potentially lower these threats. IUL is still a rather new product, and long-term actions experience is restricted.

Those attributes, specifically if the spread goes negative, can drive the item to be lapse-supported. The circumstance gets exacerbated if a firm likewise has reverse select and best price of insurance coverage prices or anticipates to eventually have unfavorable mortality margins. Insurance coverage sector historical experience has actually revealed that lapse-supported items frequently end up with ultimate abandonment prices of 1% or reduced.

Via discussions with our customers and using our sector surveys, we realize that lots of business don't model vibrant surrenders for IUL items the thought being that IUL products will not be sensitive to rate of interest motions. Firms should definitely ask themselves whether IUL will be delicate to rate of interest motions.

This can look appealing for the insurance policy holder when obtaining rates are low and the IUL illustration is showing 6% to 7% long-lasting crediting rates. What happens when those obtaining prices enhance considerably and the utilize benefit starts to shrink or vanishes? With the current rise in prices, in particular at the short end of the contour that drives borrowing rates, policyholders may make a decision to surrender their contracts.

What Is Index Life Insurance

This introduces extra actions danger as various finance or withdrawal behavior can drive various spread incomes. Agreements with reduced finance rates might also experience disintermediation if alternative financial investments end up being extra appealing about their IUL plan, in specific if caps have actually been reduced and performance is lagging expectations. Poor performance and the failure to loan or withdraw amounts that were previously shown could also bring about a rise in abandonment activity.

Similar to exactly how business research mortality and lapse/surrender, firms must regularly check their finance and withdrawal habits about presumptions and upgrade those assumptions as required. Poor efficiency and the failure to car loan or take out amounts that were formerly illustrated can likewise cause a boost in abandonment activity. Many IUL companies think some degree of decrements in setting their bush targets, as the majority of IUL contracts just pay the assured attributing price up until completion of the index year.

Maximum Funded Tax Advantaged Life Insurance

If you're utilizing a simplified overall decrement rate in hedge targets, you might absolutely introduce hedge inefficacy, particularly if the assumed overall decrement price comes to be stale due to absence of normal upgrading. Using a single decrement rate can also result in hedge inefficacy across problem year associates, as more current IUL sales would commonly have a higher real decrement rate than previously released vintages.

:max_bytes(150000):strip_icc()/indexed-universal-life-insurance.asp-Final-9f72d52f11d643c693ab8b3600f3cd27.png)

The influence of a lapse (discontinuation without worth) versus a surrender (discontinuation with worth) can trigger a meaningful distinction in incomes. Historically several firms priced and modeled their UL products with a mixed non-death discontinuation rate and an overall premium persistency assumption - indexlife. Where there is favorable money abandonment worth designed, those total non-death terminations will certainly result in an expected income source from accumulated surrender charges

Those distinctions will drive variants in actions about UL. As actuaries, we must gain from the past and try to avoid making the very same misestimations that were made on many UL products. Keeping that historical expertise, and the substantially enhanced computer power and modeling tools that are available today, you must be able to much better comprehend IUL behavior threats.

Term life and global life are significantly different products. Universal life has a variable costs and survivor benefit quantity, whereas term is dealt with; universal life is a permanent life insurance policy product that accumulates money worth, whereas term life just lasts for a specific period of time and only consists of a survivor benefit.

Guaranteed Universal Life Insurance Quotes

You can underpay or avoid costs, plus you may be able to change your fatality advantage.

Flexible costs, and a survivor benefit that may likewise be adaptable. Cash money worth, in addition to possible growth of that value with an equity index account. An alternative to assign part of the cash money worth to a fixed passion choice. Minimum passion rate assurances ("floors"), but there might also be a cap on gains, commonly around 8%-12%. Accumulated cash worth can be used to reduced or potentially cover premiums without subtracting from your survivor benefit.

Is Indexed Life Insurance A Good Investment

Insurance holders can make a decision the percent alloted to the repaired and indexed accounts. The value of the selected index is tape-recorded at the start of the month and compared to the worth at the end of the month. If the index boosts during the month, rate of interest is contributed to the cash value.

Table of Contents

Latest Posts

Index Linked Term Insurance

Iul Marketing

Iul Online

More

Latest Posts

Index Linked Term Insurance

Iul Marketing

Iul Online